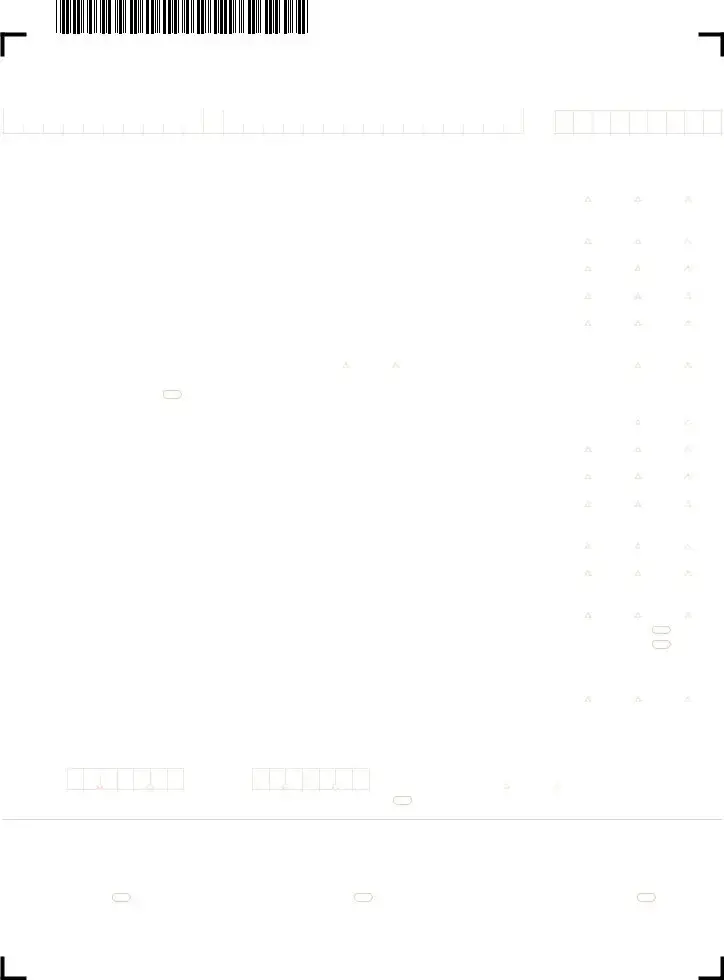

What is Form 1 Massachusetts Resident Income Tax Return and who needs to file it?

Form 1 Massachusetts Resident Income Tax Return is a document that all Massachusetts residents must fill out and submit to the Massachusetts Department of Revenue to report their annual income and calculate state taxes owed. If you lived in Massachusetts and earned income during the tax year, you're required to file this form unless your income level falls below the state's filing threshold.

Can I file Form 1 electronically, and are there any benefits to doing so?

Yes, you can file Form 1 electronically through the Massachusetts Department of Revenue website at mass.gov/dor. Filing electronically is recommended as it can lead to a faster refund. It's also more secure and reduces the risk of errors, which are more common when filing paper returns.

What is Schedule HC, and why must I enclose it with my tax return?

Schedule HC is the Health Care Information schedule, which all Massachusetts residents must fill out when filing their tax return. It's used to report information about your health insurance and to show that you had health coverage throughout the tax year, as required by Massachusetts law. Failing to submit Schedule HC could result in penalties.

What should I do if my return involves reporting amendments due to federal changes?

If your tax return needs amendments due to changes in your federal tax return, you must indicate this by selecting the "Amended return due to federal change" option on Form 1. You'll likely need to provide a detailed explanation of these changes and may need to submit additional documentation, such as a revised federal tax return.

How do I report my eligibility for the State Election Campaign Fund contribution?

To report your eligibility for the State Election Campaign Fund contribution, you simply fill in the appropriate oval on Form 1 and specify the amount ($1 for the taxpayer and/or $1 for the spouse). This contribution does not affect your tax owed or reduce your refund. It's a way for taxpayers to support the financing of state elections.

Is there a section on the form to indicate if I served in the U.S. Armed Services?

Yes, Form 1 includes a section where veterans of the U.S. Armed Services who served in specific operations can indicate their service. This acknowledgment can lead to certain tax benefits and considerations, so it's important to correctly fill in this section if it applies to you.

What are the implications of filling in the "noncustodial parent" oval on the form?

By indicating that you're a noncustodial parent on Form 1, you may affect the determination of your eligibility for certain tax benefits related to dependents, such as exemptions or credits. This could include adjustments in calculating your taxable income and the amount of tax owed or refund due. Ensure you understand how this designation impacts your tax situation, possibly consulting with a tax professional for guidance.