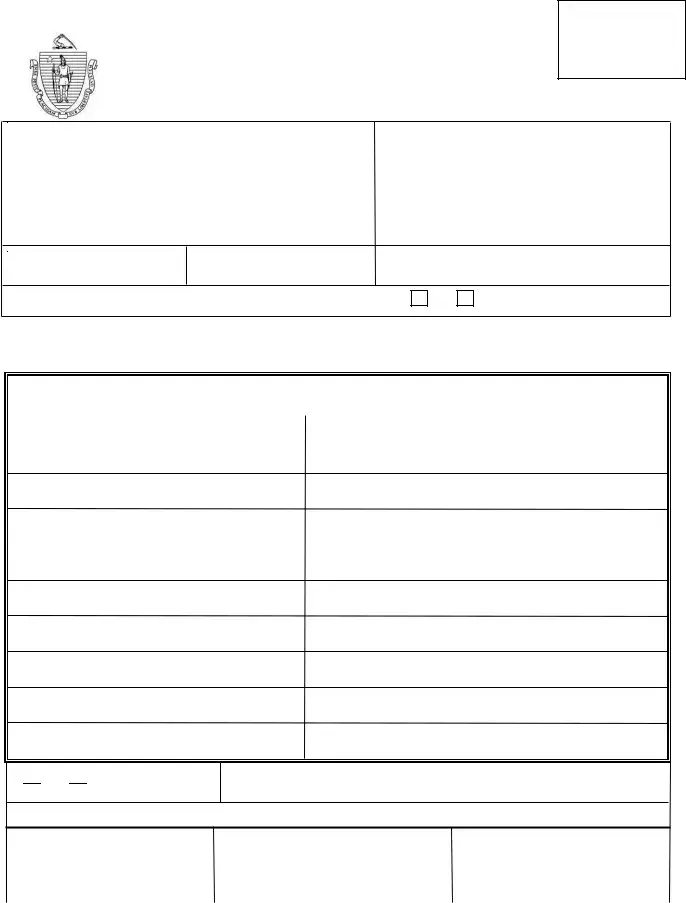

Fill Your Massachusetts 127 Form

The Massachesetts 127 form, formally designated for the Commonwealth of Massachusetts Department of Industrial Accidents, serves as an Average Weekly Wage Computation Schedule. It precisely captures a detailed record of an employee's wages for the 52 weeks preceding an accident, contributing significantly to the calculation of benefits in the event of a workplace injury. If you or someone you know needs to navigate the complexities of reporting wages after a work-related injury, click the button below to fill out the form with accurate and comprehensive details.

Make My Massachusetts 127 Online

Fill Your Massachusetts 127 Form

Make My Massachusetts 127 Online

Make My Massachusetts 127 Online

or

Get Massachusetts 127 File

One more step to finish this form

Fill in and edit Massachusetts 127 online in minutes. Skip printing and scanning.

Yes

Yes

No

No