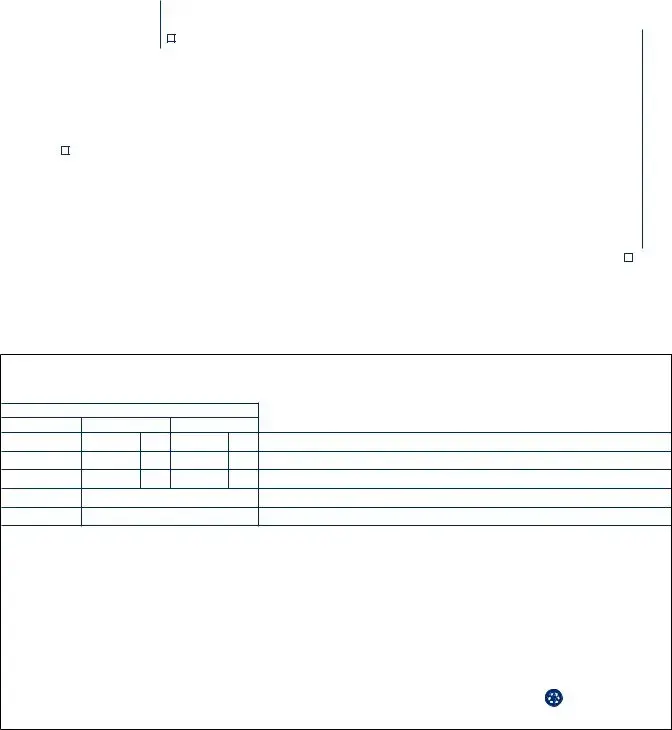

What is the Massachusetts M 941A form?

The Massachusetts M 941A form is a document that employers in Massachusetts must fill out and submit to the state's Department of Revenue. It's an annual return form for income taxes that have been withheld from employees' wages. Employers are required to file this form each year, even if no tax is due.

Who needs to file the M 941A form?

Any employer that has withheld income taxes from employees' wages in Massachusetts is required to file the M 941A form. This includes businesses of all sizes, whether they have withheld taxes for one employee or for many employees.

When is the M 941A form due?

The M 941A form must be submitted to the Massachusetts Department of Revenue on or before January 31st following the year in which the income taxes were withheld.

What should I do if I find a mistake in the information provided on the M 941A form?

If you discover that any information on the M 941A form is incorrect, you should look at the instructions provided with the form for guidance on how to make corrections. Generally, adjustments can be made for prior amounts withheld by entering the corrected information in the designated area on the form. There's a section for explaining adjustments, and it's important to provide a clear reason for any changes.

How do I make a payment along with the M 941A form?

Payments can be made by check accompanying the form submission. Checks should be made payable to the Commonwealth of Massachusetts and mailed to the address listed on the form. If using electronic funds transfer (EFT), there's an option to indicate this choice on the form as well.

What do I do if I need to close my business's withholding tax account?

There's a checkbox on the M 941A form specifically for employers who wish to close their withholding tax account in conjunction with filing their annual return. You should check this box if you're submitting your final return and want the Department of Revenue to close your account.

What if no taxes were withheld during the year?

Even if no taxes were withheld during the year, employers are still required to file the M 941A form. In this case, you should enter “0” in the relevant lines to indicate that no taxes were withheld.

Where do I mail the completed M 941A form?

The completed M 941A form, along with any payment due, should be mailed to the Massachusetts Department of Revenue at PO Box 7042, Boston, MA 02204. It's important to ensure that the form is mailed by the due date to avoid any penalties or interest.