What is the purpose of the Massachusetts Payment Voucher form?

The Massachusetts Payment Voucher form is designed to facilitate the process of making payments by state departments and organizations. Its purpose is to ensure that goods received or services rendered to the Commonwealth of Massachusetts are paid for in an organized, efficient, and verifiable manner. The form collects all necessary information, such as details about the vendor, services or goods provided, payment terms, and certifications, ensuring a seamless payment process and adherence to the state’s financial regulations.

How do I correctly fill out the Payment Voucher Input Form?

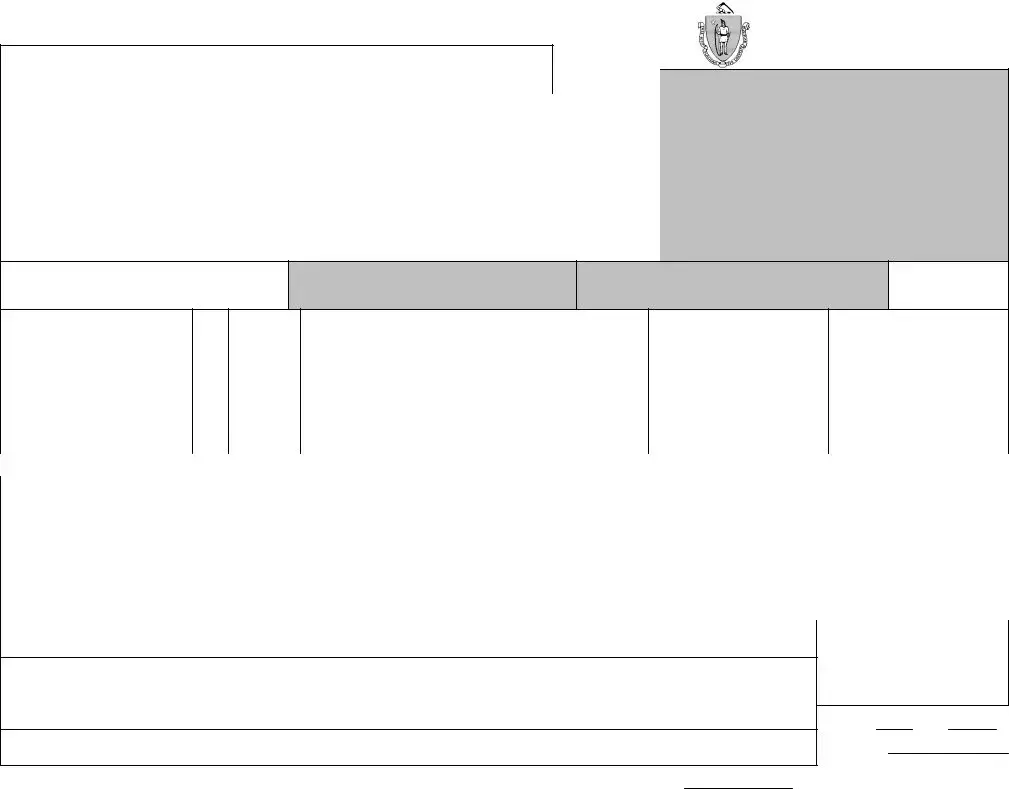

To fill out the form correctly, start by providing the Department/Organization Name, Document ID, Transaction Department R/Org Number, PV Date, Accounting Period, and Budget Fiscal Year at the top of the form. Under the Vendor's Certification section, include the Vendor Name and Address, Document Total, Payment Reference Number, and Vendor Code. It's important to sign in ink where indicated to certify that the goods were shipped or the service was provided. Fill in the shaded areas with the requested information regarding the services or goods provided, including line quantities, descriptions, unit prices, amounts, and relevant reference IDs. Always double-check to ensure all fields are accurately completed before submitting the form.

Where should inquiries regarding the form be directed?

Inquiries about the Massachusetts Payment Voucher form should be directed to the state organization associated with the payment. The bottom left corner of the form provides an area for the organization’s contact information. This should include a phone number, ensuring vendors have a direct line to ask questions or seek clarification on the payment process.

Who needs to sign the Massachusetts Payment Voucher form?

The form requires signatures from several key individuals. First, the vendor or a representative must sign under the Vendor's Certification to confirm that the services or goods were provided. Additionally, the form must be signed by the person preparing the form, indicating their title and the date. Another signature is required from an individual entering data into the system, along with their title and the date. Lastly, an authorized signatory must approve the document, affirming its accuracy, completeness, and compliance with applicable laws.

What is the “Department/Organization Name” field for?

The “Department/Organization Name” field is important because it identifies which Massachusetts state department or organization is initiating the payment. This ensures that the payment is correctly processed and attributed, helping in the management and tracking of state funds allocated for various services and goods.

Is there a specific pen color required when signing the document in ink?

While the form specifies that signatures must be in ink, it does not stipulate a required color. However, for legibility and document scanning purposes, it's commonly preferred to sign in blue or black ink. These colors make signatures easy to distinguish from the printed text, ensuring that the document remains clear and official-looking when photocopied or scanned.

What should I do if I make a mistake on the form?

If a mistake is made while filling out the form, the best course of action is to clearly cross out the incorrect information, enter the correct data nearby, and initial any changes. For significant errors or if the form becomes too cluttered or illegible, it’s advisable to start over with a new form to ensure all information is presented clearly and accurately. Always check with the relevant state department if you're unsure about how to correct an error on the form.