What is Form TA-1 and who needs to file it?

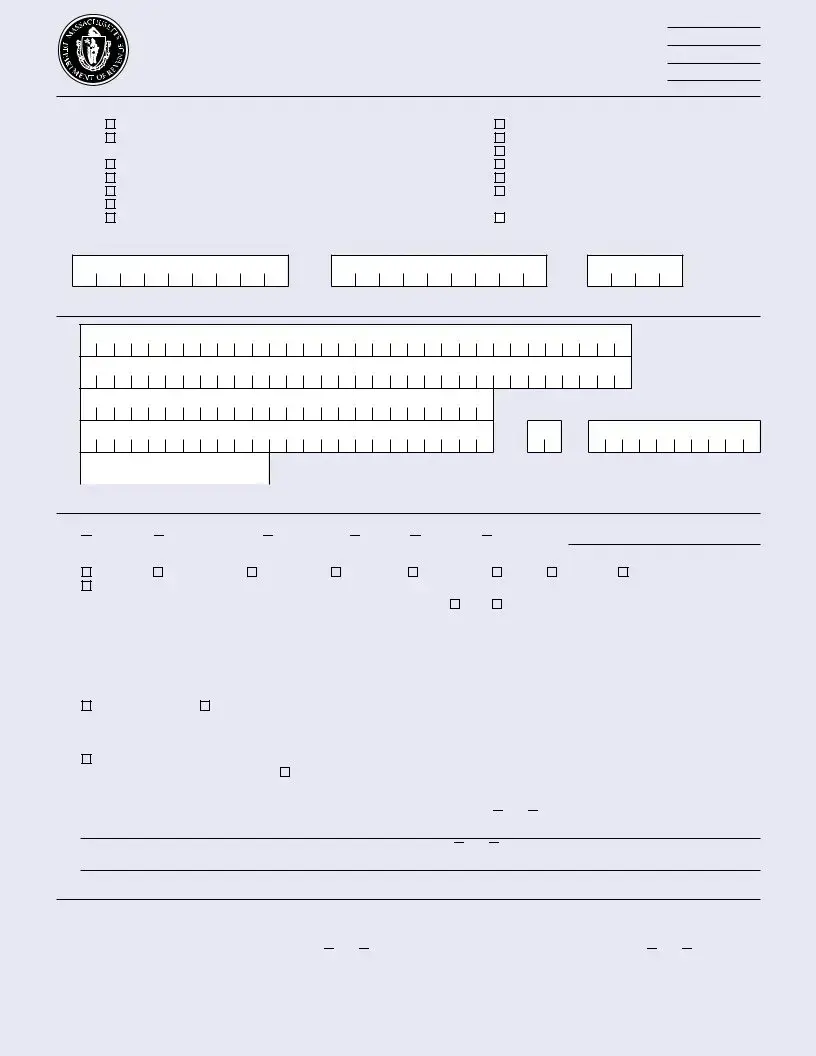

Form TA-1, known as the Application for Original Registration, is a document required by the Massachusetts Department of Revenue. It is essential for businesses or organizations operating within the state that need to register for one or more tax types such as sales and use tax, meals tax, room occupancy excise, and others listed on the form. This includes new businesses, those purchasing an existing business, or current businesses undergoing an organizational change.

What are the key sections of the Form TA-1?

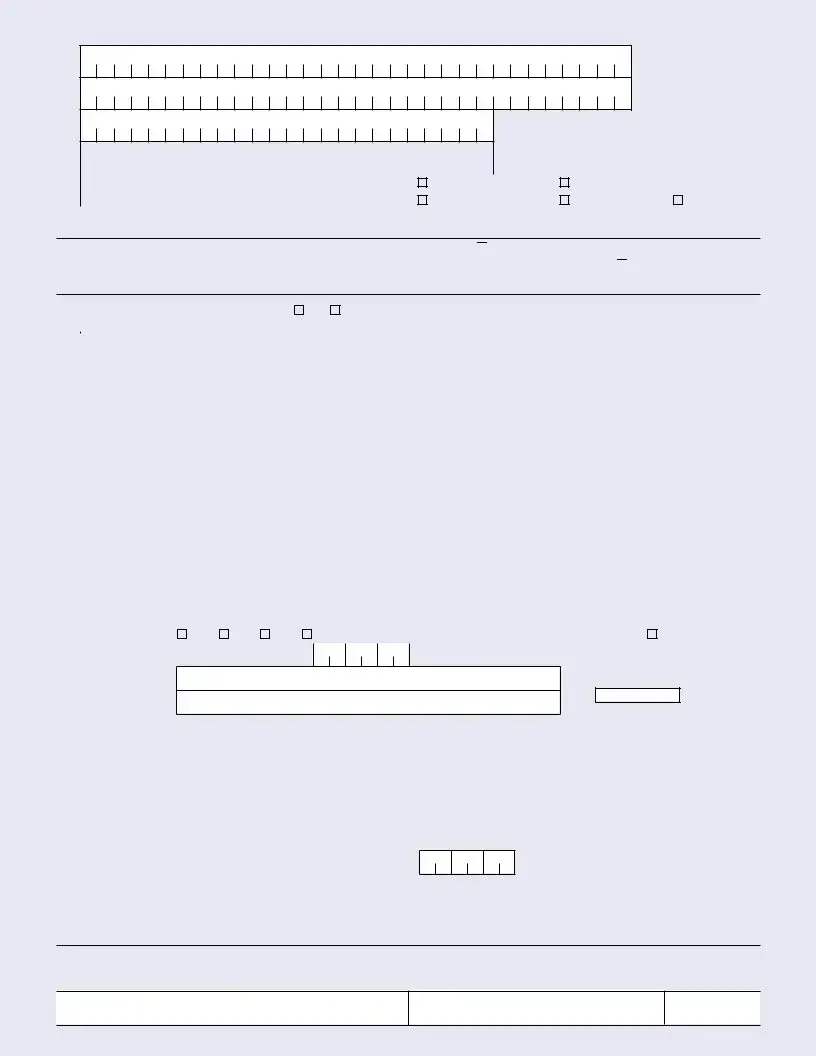

The form is divided into several sections including general information about the business, type of taxes for which registration is sought like payroll tax, sales/use tax, room occupancy excise, etc., federal and state identification numbers, number of business locations, and contact details. It also includes sections for exempt organizations and specific details depending on the tax types selected such as the estimated amount of tax to be withheld or paid.

How does a business determine its tax obligations on Form TA-1?

To determine its tax obligations, a business needs to review the types of transactions it conducts, the nature of its goods or services, and its customers. The form lists various tax types that a business may be responsible for, such as sales/use tax on goods, telecommunications services, meals tax, and others. A business must evaluate which of these tax categories apply based on its operations and check the relevant boxes on the form.

Can organizations apply for tax-exempt status using Form TA-1?

Yes, organizations that qualify for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code can apply for exempt purchaser status through Form TA-1. They must include a copy of their IRS letter of exemption and, if applicable, a copy of the group exemption ruling and directory page listing for approved subordinate organizations. The form contains specific questions regarding exemption from U.S. income taxes and local property taxes to determine eligibility.

What should a business do if it undergoes an organizational change?

If a business undergoes an organizational change, it must report this on Form TA-1 by selecting the "Organizational change" reason for applying and providing the Federal Identification Number and close date of the previous organization. This is crucial for ensuring that the Massachusetts Department of Revenue has up-to-date information on the business's structure and tax obligations.

Where and how is Form TA-1 submitted?

Form TA-1 should be mailed to the Massachusetts Department of Revenue, Data Integration Bureau, PO Box 7022, Boston, MA 02204. The business owner or authorized representative must sign the form, certifying under the pains and penalties of perjury that the information provided is true and correct. Signing the form also acknowledges individual and personal responsibility for any sums required to be paid to the Commonwealth as outlined under specific Massachusetts General Laws.

Corporation

Corporation

Trust or association

Trust or association  Sole proprietor

Sole proprietor  Fiduciary

Fiduciary

Partnership

Partnership

Other (specify):

Other (specify): Yes

Yes  No. If yes, please explain:

No. If yes, please explain: Yes

Yes  No. If yes, please explain:

No. If yes, please explain: Yes

Yes  No. B. Are you exempt from paying local property taxes?

No. B. Are you exempt from paying local property taxes?  Yes

Yes  No.

No.

(see pages

(see pages