What is the MPC 160 form used for in Massachusetts?

The MPC 160 form, formally known as the "Petition for Formal Probate of a Will and/or Appointment of a Personal Representative," is a legal document used in the Commonwealth of Massachusetts. It's filed in the Probate and Family Court when someone needs to formally prove the validity of a deceased person's will, establish the legal process for distributing the deceased person's assets (known as intestacy if there is no will), or appoint a personal representative (also known as an executor) to manage the deceased's estate.

Who can file an MPC 160 form?

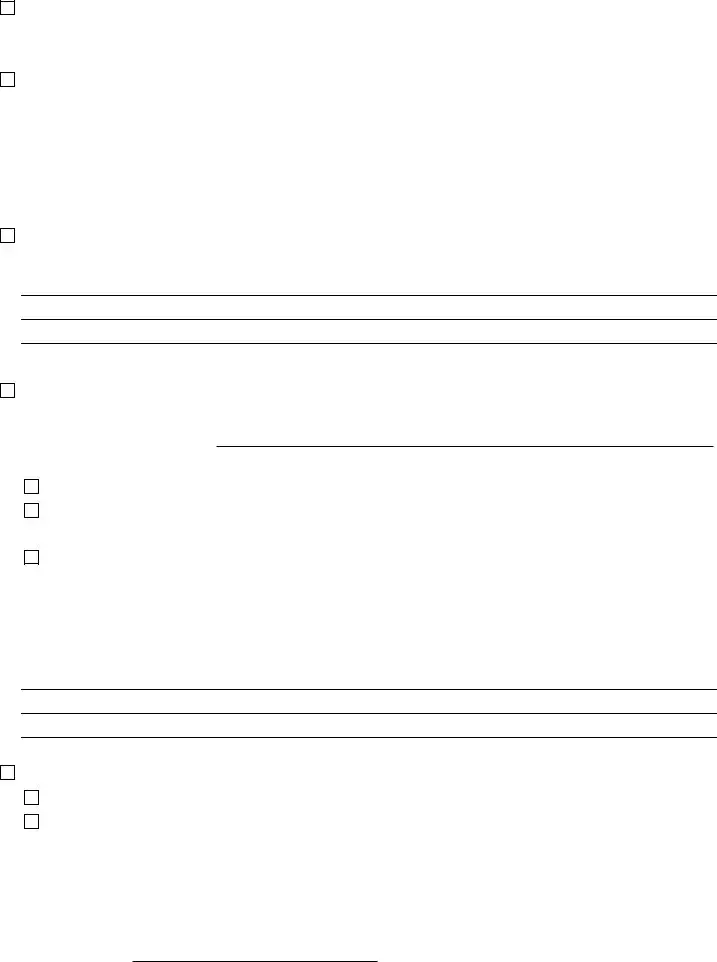

Interested persons such as a beneficiary named in the will, a surviving spouse, heir, devisee (someone named in the will to inherit), or a personal representative named in the will are eligible to file the MPC 160 form. In cases where an estate might not have a will, close relatives or other interested parties may also have the standing to file this form.

What does it mean to be an “interested person”?

In the context of estate administration, an "interested person" refers to anyone who has a stake in the outcome of the estate’s proceedings. This includes heirs, spouses, creditors, beneficiaries named in a will, and others who might either inherit from or have claims against the estate.

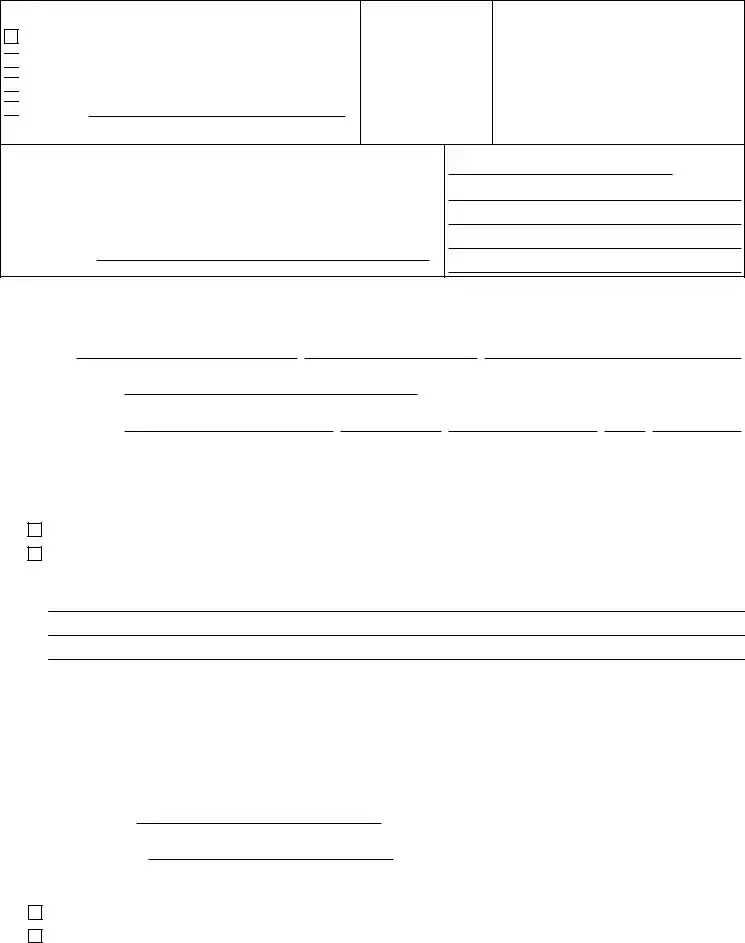

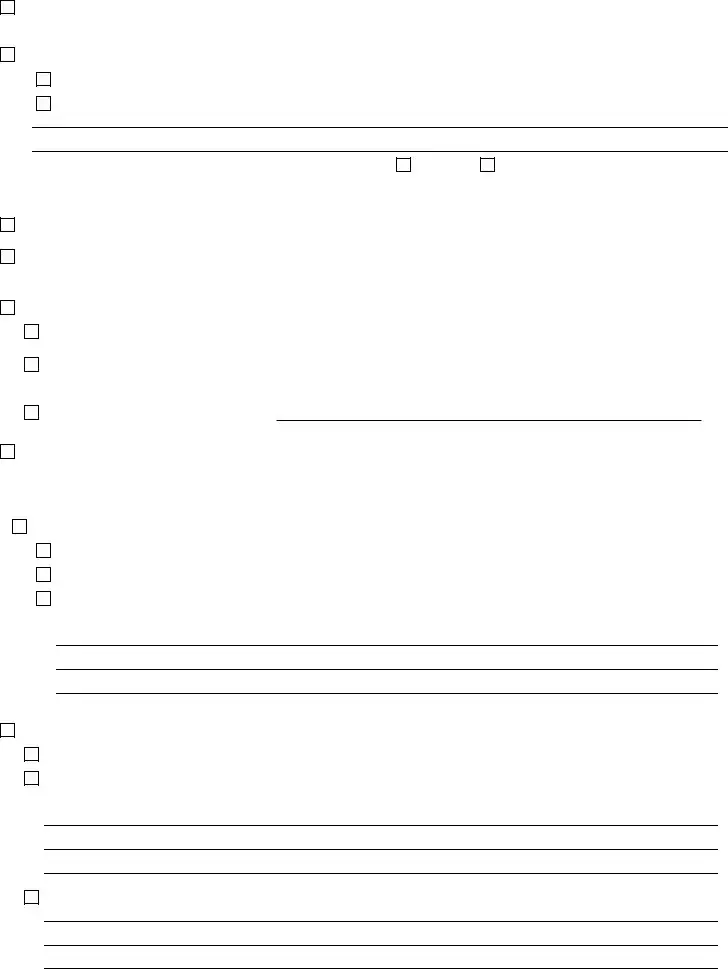

What information is required on the MPC 160 form?

This form asks for detailed information about the deceased (decedent), including their name, date of death, address, and whether a death certificate is available. It also requires information about the petitioner, the legal basis for the proceeding (e.g., existence of a will or intestacy), details on the decedent's spouse and children, if applicable, and a listing of heirs or others entitled to inherit. Additionally, the form asks whether the petitioner seeks unsupervised or supervised administration of the estate.

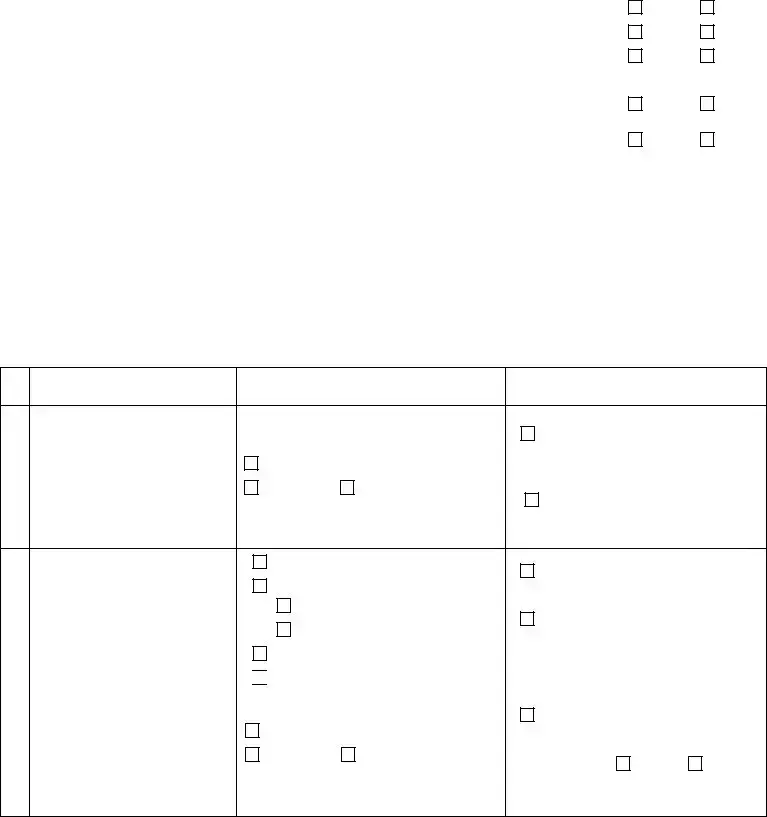

What does it mean to request supervised or unsupervised administration?

When submitting an MPC 160, the petitioner can request either supervised or unsupervised administration of the estate. Supervised administration involves the court closely overseeing the process, including the approval of various steps taken by the personal representative. Unsupervised administration allows the personal representative to manage the estate without the court's direct oversight, although certain legal requirements must still be met.

Is a death certificate necessary to file the MPC 160 form?

Yes, a death certificate is typically required to file the MPC 160 form as it officially proves the death of the deceased. The form provides options to indicate whether a death certificate is available, and if not, it asks for an explanation of why it cannot be provided.

Can you amend the MPC 160 form after filing?

Yes, if there are mistakes or if additional information becomes available after the initial filing, the petitioner can amend the MPC 160 form. This process might require filing another form or providing a written statement to the court, depending on the nature of the changes.

Where do you file the MPC 160 form in Massachusetts?

The MPC 160 form is filed in the Probate and Family Court in the county where the deceased was domiciled at the time of death or, if the deceased was not a Massachusetts resident, in any county where the deceased’s property is located.

ADJUDICATION OF INTESTACY

ADJUDICATION OF INTESTACY

APPOINTMENT OF A PERSONAL REPRESENTATIVE

APPOINTMENT OF A PERSONAL REPRESENTATIVE

OTHER:

OTHER:

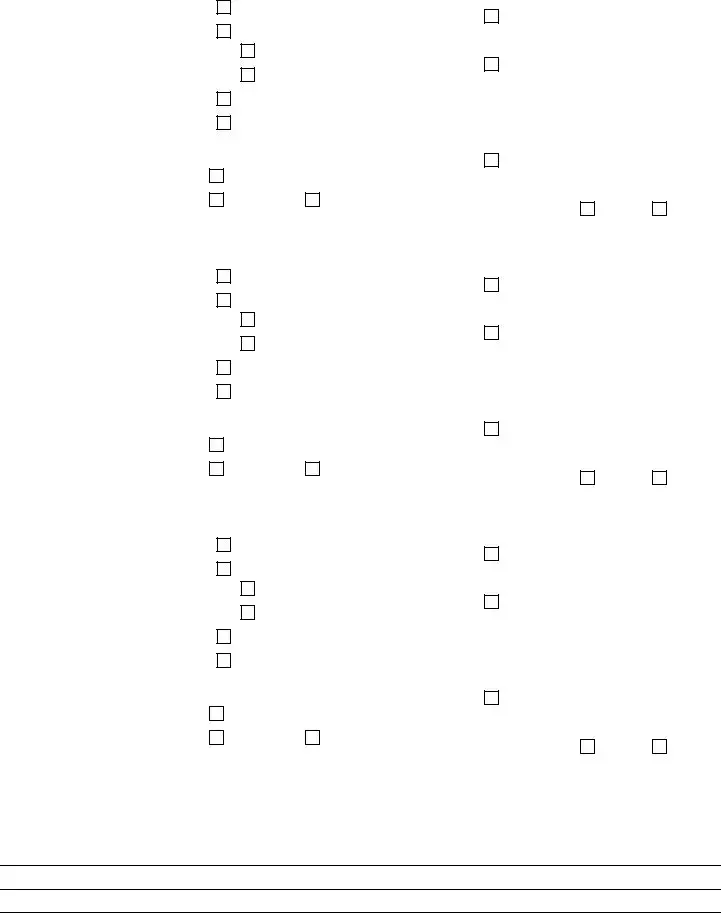

Other heir (List relationship):

Other heir (List relationship):

The dates of all codicils are

The dates of all codicils are

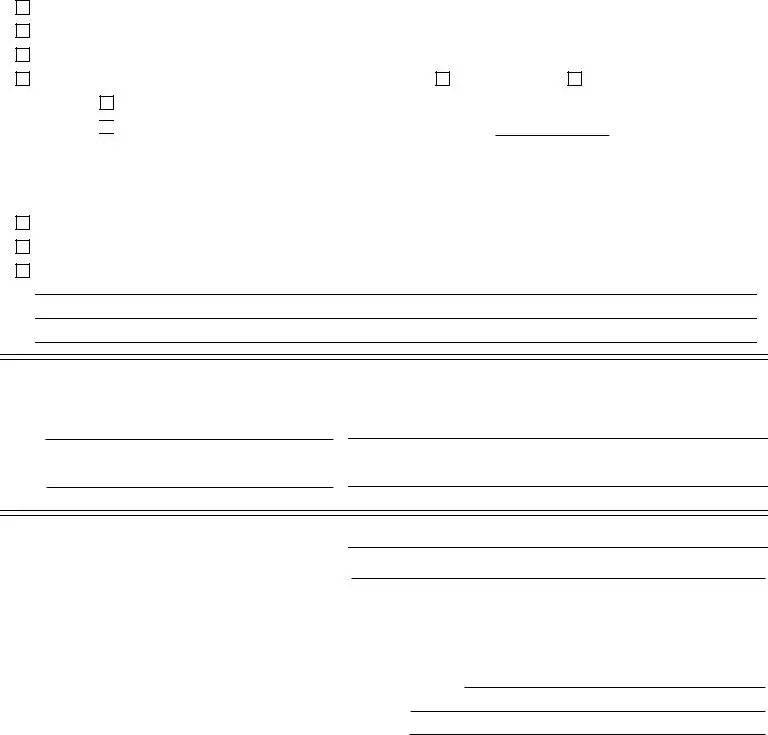

with sureties on the bond with the penal sum amount of $ and that Letters be issued.

with sureties on the bond with the penal sum amount of $ and that Letters be issued.