Specific Instructions

Name. If you are an individual, you must generally enter the name shown on your social security card. However, if you have changed your last name, for instance, due to marriage without informing the Social Security Administration of the name change, enter your first name, the last name shown on your social security card, and your new last name.

If the account is in joint names, list first and then circle the name of the person or entity whose number you enter in Part I of the form.

Sole proprietor. Enter your individual name as shown on your social security card on the “Name” line. You may enter your business, trade, or “doing business as (DBA)” name on the “Business name” line.

Limited liability company (LLC). If you are a single-member LLC (including a foreign LLC with a domestic owner) that is disregarded as an entity separate from its owner under Treasury regulations section 301.7701-3, enter the owner’s name on the “Name” line. Enter the LLC’s name on the “Business name” line.

Caution: A disregarded domestic entity that has a foreign owner must use the appropriate Form W-8.

Other entities. Enter your business name as shown on required Federal tax documents on the “Name” line. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on the “Business name” line.

Part I - Taxpayer Identification

Number (TIN)

Enter your TIN in the appropriate box.

If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter it in the social security number box. If you do not have an ITIN, see How to get a TIN below.

If you are a sole proprietor and you have an EIN, you may enter either your SSN or EIN. However, the IRS prefers that you use your SSN.

If you are an LLC that is disregarded as an entity separate from its owner (see Limited liability company (LLC) above), and are owned by an individual, enter your SSN (or “pre-LLC” EIN, if desired). If the owner of a disregarded LLC is a corporation, partnership, etc., enter the owner’s EIN.

Note: See the chart on this page for further clarification of name and TIN combinations.

How to get a TIN. If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form SS-5, Application for a Social Security Card, from your local Social Security Administration office. Get Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can get Forms W-7 and SS-4 from the IRS by calling 1-800-TAX-FORM (1-800-829- 3676) or from the IRS’s Internet Web Site www.irs.gov.

If you do not have a TIN, write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. For interest and dividend payments, and certain payments made with respect to readily tradable instruments, generally you will have 60 days to get a TIN and give it to the requester before you are subject to backup withholding on payments.

The 60-day rule does not apply to other types of payments. You will be subject to backup withholding on all such payments until you provide your TIN to the requester.

Note: Writing “Applied For” means that you have already applied for a TIN or that you intend to apply for one soon.

Part II - Certification

To establish to the paying agent that your TIN is correct or you are a U.S. person, or resident alien, sign Form W-9.

For a joint account, only the person whole TIN is shown in Part I should sign (when required).

Real estate transactions. You must sign the certification. You may cross out item 2 of the certification.

Dunn and Bradstreet Universal Numbering System (DUNS) number requirement –

The United States Office of Management and Budget (OMB) requires all vendors that receive federal grant funds have their DUNS number recorded with and subsequently reported to the granting agency. If a contractor has multiple DUNS numbers the contractor should provide the primary number listed with the Federal government’s Central Contractor Registration (CCR) at /www.ccr.gov . Any entity that does not have a DUNS number can apply for one on- line at http://www.dnb.com/us/

under the DNB D-U-N Number Tab.

Privacy Act Notice

Section 6109 of the Internal Revenue Code requires you to give your correct TIN to persons who must file information returns with the IRS to report interest, dividends, and certain other income paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, cancellation of debt, or contributions you made to an IRA or MSA. The IRS uses the numbers for identification purposes and to help verify the accuracy of your tax return. The IRS may also provide this information to the Department of Justice for civil and criminal litigation, and to cities, states, and the District of Columbia to carry out their tax laws

You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold a designated percentage, currently 28% of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to a payer. Certain penalties may also apply.

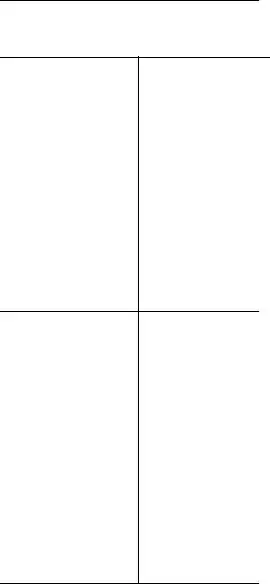

What Name and Number to Give the Requester

For this type of account: |

Give name and SSN of: |

|

|

|

1. |

Individual |

The individual |

2. |

Two or more |

The actual owner of the |

|

individuals (joint |

account or, if combined |

|

account) |

funds, the first |

|

|

individual on the |

|

|

account 1 |

3. |

Custodian account of |

The minor 2 |

|

a minor (Uniform Gift |

|

|

to Minors Act) |

The grantor-trustee 1 |

4. |

a. The usual |

|

revocable savings |

|

|

trust (grantor is |

|

|

also trustee) |

The actual owner 1 |

|

b. So-called trust |

|

account that is not |

|

|

a legal or valid |

|

|

trust under state |

|

|

law |

The owner 3 |

5. |

Sole proprietorship |

For this type of account: |

Give name and EIN of: |

|

|

|

6. |

Sole proprietorship |

The owner 3 |

7. A valid trust, estate, or |

Legal entity 4 |

|

pension trust |

|

8. |

Corporate |

The corporation |

9. |

Association, club, |

The organization |

|

religious, charitable, |

|

|

educational, or other |

|

|

tax-exempt organization |

|

10. |

Partnership |

The partnership |

11. A broker or registered |

The broker or nominee |

|

nominee |

|

12. |

Account with the |

The public entity |

|

Department of |

|

|

Agriculture in the name |

|

|

of a public entity (such |

|

|

as a state or local |

|

|

government, school |

|

|

district, or prison) that |

|

|

receives agricultural |

|

|

program payments |

|

1List first and circle the name of the person whose number you furnish. If only one person on a joint account has an SSN, that person’s number must be furnished.

2Circle the minor’s name and furnish the minor’s SSN.

3You must show your individual name, but you may also enter your business or “DBA” name. You may use either your SSN or EIN (if you have one).

4. List first and circle the name of the legal trust, estate, or pension trust. (Do not furnish the TIN of the personal representative or trustee unless the legal entity itself is not designated in the account title.)

Note: If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.

If you have questions on completing this form, please contact the Office of the State Comptroller. (617) 973-2468.

Upon completion of this form, please send it to the Commonwealth of Massachusetts Department you are doing business with.

Page 2

Form MA- W-9 (Rev. April 2009)